In recent news, calls for an extension of the Investment Tax Credit are intensifying for some of the US solar industry after the Trump administration finalized new standards that allow states to set their own emissions requirements—or none at all—on individual coal plants with the Affordable Clean Energy rule.

An extension of the Investment Tax Credit could drive more adoption of solar energy, restore federal climate leadership, and push the US closer toward achieving its clean energy goals.

But what is the Investment Tax Credit and how can project financers or developers take advantage of it?

What is the Investment Tax Credit?

The solar Investment Tax Credit (ITC) is perhaps one of the most important federal policy means to encourage the growing US solar industry. Since it was first enacted over a decade ago, solar energy in the US has grown more than 8,600%, in the process creating thousands of job opportunities and investing billions in the country’s economy and clean energy future.

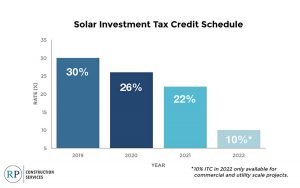

However, in spite of the tremendous success and appeal of the ITC, the rate of the tax credit is set to decrease after this year. Currently, the ITC reimburses new solar project owners 30 percent of a project’s cost if installed in 2019. At the start of 2020, the ITC drops to 26 percent, decreasing further to 22 percent in 2021, and 10 percent in 2022, where it will remain solely for commercial and utility projects.

The rapid step down of the ITC should incentivize project owners and financers to act quickly in order to take advantage of the highest available tax credit and maximize their ROI.

Safe Harbor and the ITC

The IRS has created legal methods to freeze the 30 percent ITC for future projects completing in 2020 or beyond in a process referred to as Safe Harbor.

Taking advantage of this opportunity requires strategy. Improper execution could mean losing not just the difference the ITC provided from the previous year, but the credit consideration entirely. The IRS gives 48 months to begin construction, and four years to complete and put the project into service. Not abiding by these timelines could mean losing your tax credit—and paying any potential penalties.

There are two ways a project can qualify for Safe Harbor:

The first locks the project into the ITC at the rate before the drop if construction has commenced prior to the drop and has remained under construction without interruption until the project is commissioned. This option is the more challenging of the two due to the strict process and documentation requirements. It is up to the party claiming the ITC to prove to the IRS what constitutes the start of construction and the continuous nature of the work being done on the project.

The second opportunity to be granted Safe Harbor requires project owners or financers to invest five percent of the eventual project cost by midnight of December 31, 2019. This can be used to purchase materials or project components.

For those choosing the latter method, having a warehousing solution can be significantly beneficial—and perhaps the deciding factor when contemplating which ITC path to choose. Even if you do not yet have a specific project in mind, but know what type of solar system you want to install, this second method is an effective way ensure the highest possible tax credit for your project.

RPCS’s Safe Harbor Strategy

While falling solar equipment costs is overall a positive and beneficial trend for the industry as a whole, it poses a risk to site owners and financers purchasing project materials in advance to meet the requirements of the ITC.

RPCS deploys a strategic plan that will allow project developers, financers, and owners to benefit from this year’s Investment Tax Credit (ITC) rate for projects built in the coming years.

RPCS’s Safe Harbor strategy offers complete flexibility to future projects by selecting components that are universal product parts and aren’t module or project specific. Customers can realize savings by both purchasing solar tracker materials from RPCS and storing them safely and cost effectively in RPCS’s two tracker storage facilities, located in California and Texas, to serve projects nationwide.

RPCS has the experience of engineering solar tracker projects in-house to give project owners and developers a competitive edge when it comes to planning and purchasing projects in advance in order to obtain the highest value of the ITC.

By implementing their Safe Harbor strategy, RPCS helps customers minimize risks from project or technology changes, guiding purchasing decisions toward components that will not lose their value or become barriers to other BOS selections when the projects are ready to proceed.